Mortgage affordability in Canada is one of the first things to look into if you are looking to become a first-time home buyer, relocating to another province and purchasing a home, or purchasing a more expensive home –you will want to know if you can afford to purchase a home.

As a first time home buyer, you want to ensure that you can afford a mortgage. Some things to do before you finalize a mortgage include:

- Check your credit

- Improve your credit score is it’s poor

- Set a budget for the mortgage that you can afford

- Take into consideration other costs like closing costs, moving, and so on

A mortgage calculator can also help you if you already have a mortgage. You can use the calculator to research mortgages to replace your existing one or to refinance.

Mortgage Calculators for Mortgage Affordability in Canada

By using a Mortgage calculator you can see if you can afford a mortgage. A Mortgage Affordability Calculator will assist you in determining how much mortgage you can afford.

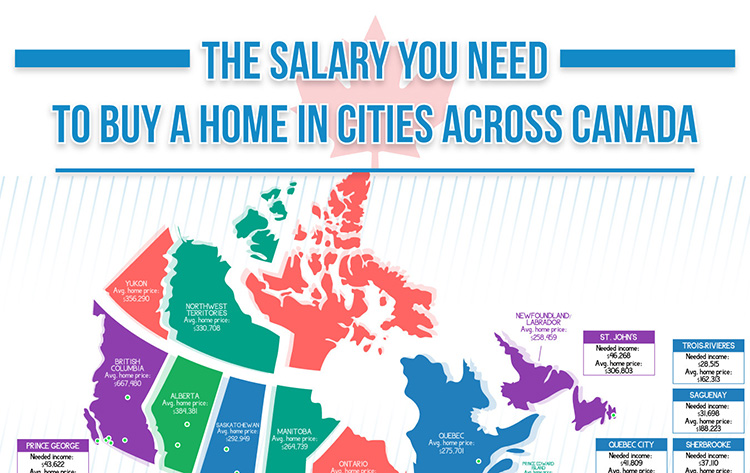

If you want a quick glance to find the average home pricing in Canada and what is salary is required, RentSeeker.ca published this wonderful Annual Housing Market Report INFOGRAPHIC showing the cost to purchase a home in cities across Canada, and the salary needed to support the purchase. Also included is a year-over-year changes purchase.

A mortgage and home purchase is long term so ensure you take the necessary steps to find out if you can afford the mortgage. Comparing Mortgage Rates can save you thousands over the course of your mortgage.